The EURAUD exchange rate tests the 50-moving average daily to hold the uptrend since February.

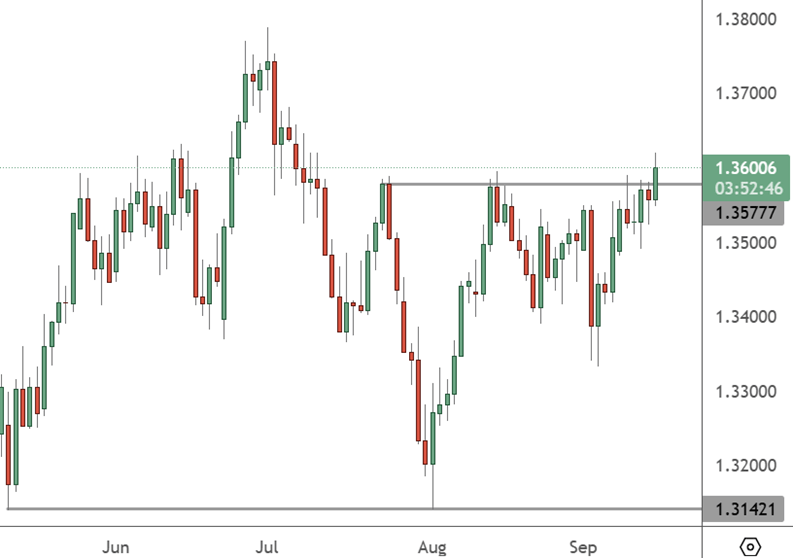

EURAUD – Daily Chart

EURAUD trades at 1.63, and the activity around this indicator should determine a bounce or correction.

Data ahead includes an important wage index from Australia ahead of Wednesday’s Asian market. Tomorrow is the release of European core inflation. However, it is a final reading and may not differ from the 5.6% previously forecast. Australian employment will follow that later, with a drop to 25k jobs added from 53k in the previous month.

Analysts at ING were watching the AUD this week, saying:

“The Reserve Bank of Australia (RBA) minutes opened the door to more tightening if necessary, and tomorrow we’ll see the first quarter wage price index in Australia, which is expected to rise from 3.3% to 3.6% YoY. Any upside surprise may prompt some bets on further tightening by the RBA and offer some support to AUD: at the moment, markets are not expecting any more hikes.”

“On Thursday, April employment figures will also be released and could confirm a still very tight jobs market.”

Westpac consumer confidence was disappointing, with a reading of 79. After last month’s jump to 85.8, there was hope the index could beat the highs of last June. The Australian Reserve Bank surprises markets with another quarter-point interest rate increase, and investors will be looking at the data for the potential of further rate hikes in the future. Employment data has been weakening, but wage rises are continuing.

The Australian Bureau of Statistics (ABS) said the consumer price index is up 7% in the year to March. Governor Philip Lowe of the RBA said inflation was the reason for further rate increases.

“Inflation in Australia has passed its peak, but at 7% is still too high and it will be some time yet before it is back in the target range,” he said.

“Members also agreed that further increases in interest rates may still be required, but that this would depend on how the economy and inflation evolve,” minutes from the meeting said.