Bitcoin was sharply lower after market dynamics showed that the rally may have run out of steam.

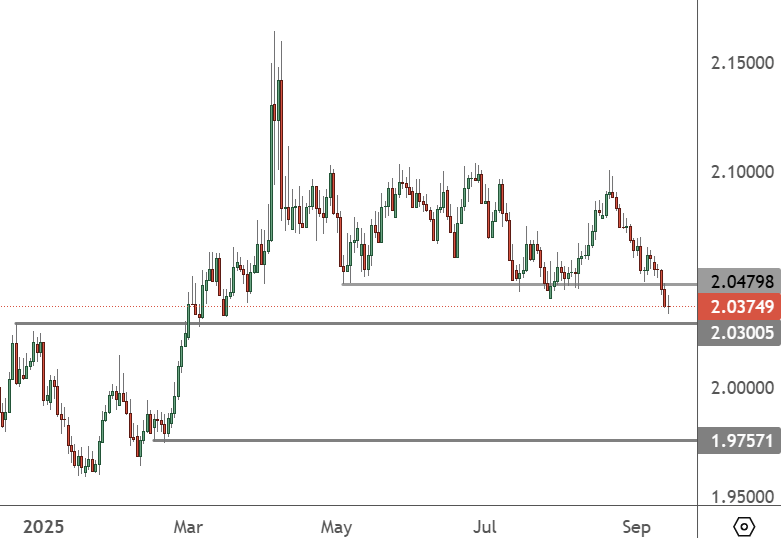

BTCUSD – Daily Chart

The price of BTCUSD failed to sustain gains above $112,000 and has opened the door to a retest of the $107,443 level. A move toward $100,000 cannot be ruled out from here.

Bitcoin, the world’s largest cryptocurrency by market capitalisation, has entered a “historically late phase” of the cycle, with profit-taking metrics and capital flows similar to those of previous cycle highs. That is the assessment of crypto data firm Glassnode.

Data showed that Bitcoin’s current upmove has similarities with the 2015–2018 and 2018–2022 runs, where all-time highs (ATHs) were reached roughly two to three months after the present relative stage.

The company noted that Bitcoin’s circulating supply has spent 273 consecutive days above the +1 standard deviation profit band, second only to the 335-day streak seen during the 2015–2018 cycle. Long-term coin holders (LTHs) have already taken more profits than in all but one past cycle, signalling that sell-side pressure is mounting and short-term money is propping up the market move.

“These signals reinforce the view that the current cycle is firmly in its historically late phase,” Glassnode wrote in a weekly report, while also noting that in previous cycles, these types of behaviours often preceded new all-time highs within months.

CryptoQuant data also highlighted the problem, with the newest Bitcoin holders (wallets under one month old) now net positive, as the supply held by this group grew by 73,702 BTC in September. It is a worrying sign for speculative markets that stock markets are dominated by retail money, and inexperienced traders are now propping up BTC trading.

Despite an increase in new entrants, there were still signs of appetite from large investors. So-called whale investors continue adding new holdings, with wallets holding 10 to 10,000 coins, increasing their stack to over 56,000 coins since late August. Exchange balances were also lower by 31,000 BTC in the last month, which can reduce the number of coins available for sale in the near term.

Ahead of the latest selling, ETF inflows had suffered a $439 million sell-off, wiping out most of the previous week’s flows after Fed Chair Jerome Powell remained focused on inflation talk. Bitcoin ETFs were the hardest hit, with $363.1 million in outflows, led by a $276 million loss at Fidelity’s FBTC and ARK 21Shares’ ARKB, which suffered outflows of $52 million. These numbers could get worse if traders take further profits at these levels.

The U.S. tech stock index was also lower on the day, with the market reeling from Powell’s hawkish stance, while BTC holding company MSTR lost almost 10% of its market cap on the day.