Market Highlight 30/12/2025

Global markets turned more defensive on Monday as sharp volatility in precious metals and renewed geopolitical tensions weighed on sentiment. The U.S. Dollar Index traded sideways near recent lows, closing slightly lower at 98.01, while U.S. Treasury yields declined across the curve. The benchmark 10-year yield eased to 4.111%, and the policy-sensitive 2-year yield fell to 3.438%, reflecting persistent uncertainty over the Federal Reserve’s policy outlook amid rising political pressure and market volatility.

Risk assets weakened broadly. U.S. equity indices closed lower, led by declines in technology stocks. Commodities saw pronounced divergence: spot gold suffered a sharp $200 intraday sell-off to close below $4,350, while silver experienced extreme swings after hitting record highs. In contrast, oil prices rebounded on ongoing Russia–Ukraine uncertainties and Middle East tensions, with both WTI and Brent crude rising more than 1%, highlighting the market’s continued sensitivity to geopolitical risk.

Key Outlook 30/12/2025

Markets will focus on the release of the U.S. October House Price Index later today. The index is expected to rise by 0.1% month-on-month, compared with a flat reading previously. A stronger-than-expected result would reinforce signs of resilience in the U.S. housing sector, potentially supporting the U.S. dollar and U.S. equity indices, while a weaker print could revive concerns over slowing domestic demand and temper risk sentiment.

Key Data and Events Today:

- 22:00 US House Price Index MoM OCT **

Tomorrow:

- 03:00 FOMC Minutes ***

- 05:30 API Crude Oil Stock Change ***

- 09:30 CN NBS Manufacturing PMI DEC **

- 21:30 US Initial Jobless Claims ***

Markets Analysis 30/12/2025

EURUSD

- Resistance: 1.1820 / 1.1839

- Support: 1.1738 / 1.1719

A softer USD, driven by year-end profit-taking and expectations of Fed rate cuts in 2026, continues to underpin EUR/USD, while euro-specific catalysts remain limited. Technically, price is consolidating near the top of its ascending channel, capped by resistance at 1.1820–1.1839, with key support seen around 1.1738–1.1719.

GBPUSD

- Resistance: 1.3581 / 1.3650

- Support: 1.3472 / 1.3403

Sterling continues to track broad USD moves as Fed 2026 rate-cut expectations clash with year-end profit-taking, while UK-specific catalysts remain scarce. Technically, GBP/USD is consolidating within an ascending channel, facing resistance near 1.3581–1.3650, with downside support clustered around the 1.3403 area.

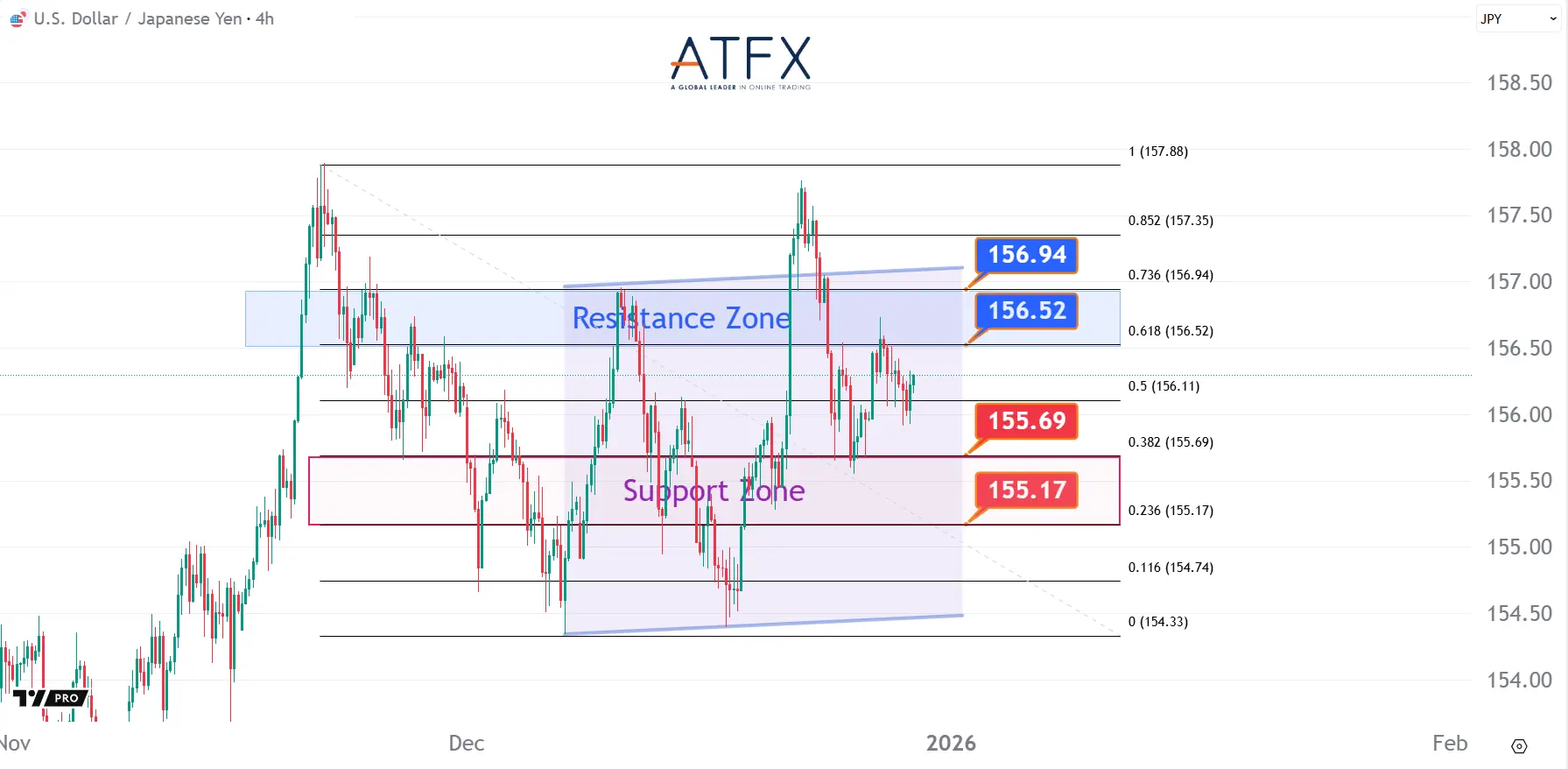

USDJPY

- Resistance: 156.52 / 156.94

- Support: 155.69 / 155.17

The yen stayed firm after BoJ minutes reinforced discussions on further rate hikes, keeping USD/JPY upside capped despite thin year-end liquidity. Technically, the pair remains range-bound below the 156.52–156.94 resistance zone, with a break below 155.17–155.69 likely opening deeper downside pressure.

US Crude Oil Futures (FEB)

- Resistance: 58.42 / 58.87

- Support: 57.38/ 56.92

Oil prices edged higher despite year-end risk-off sentiment, supported by renewed geopolitical tensions linked to Russia–Ukraine and the Middle East. From a technical perspective, prices remain capped below the 58.42–58.87 resistance zone, while 56.92–57.38 continues to act as a key near-term support area.

Spot Gold

- Resistance: 4,421 / 4,488

- Support: 4,275 / 4,209

Spot Silver

- Resistance: 75.55 / 79.79

- Support: 70.41 /66.25

Gold retreated sharply after failing to hold record highs, with year-end profit-taking and thin liquidity amplifying the pullback, while geopolitical risks continue to limit downside. From a technical perspective, price slipped back into a prior congestion area, with focus now shifting to whether buying interest can stabilize the move around the 4,275–4,209 zone.

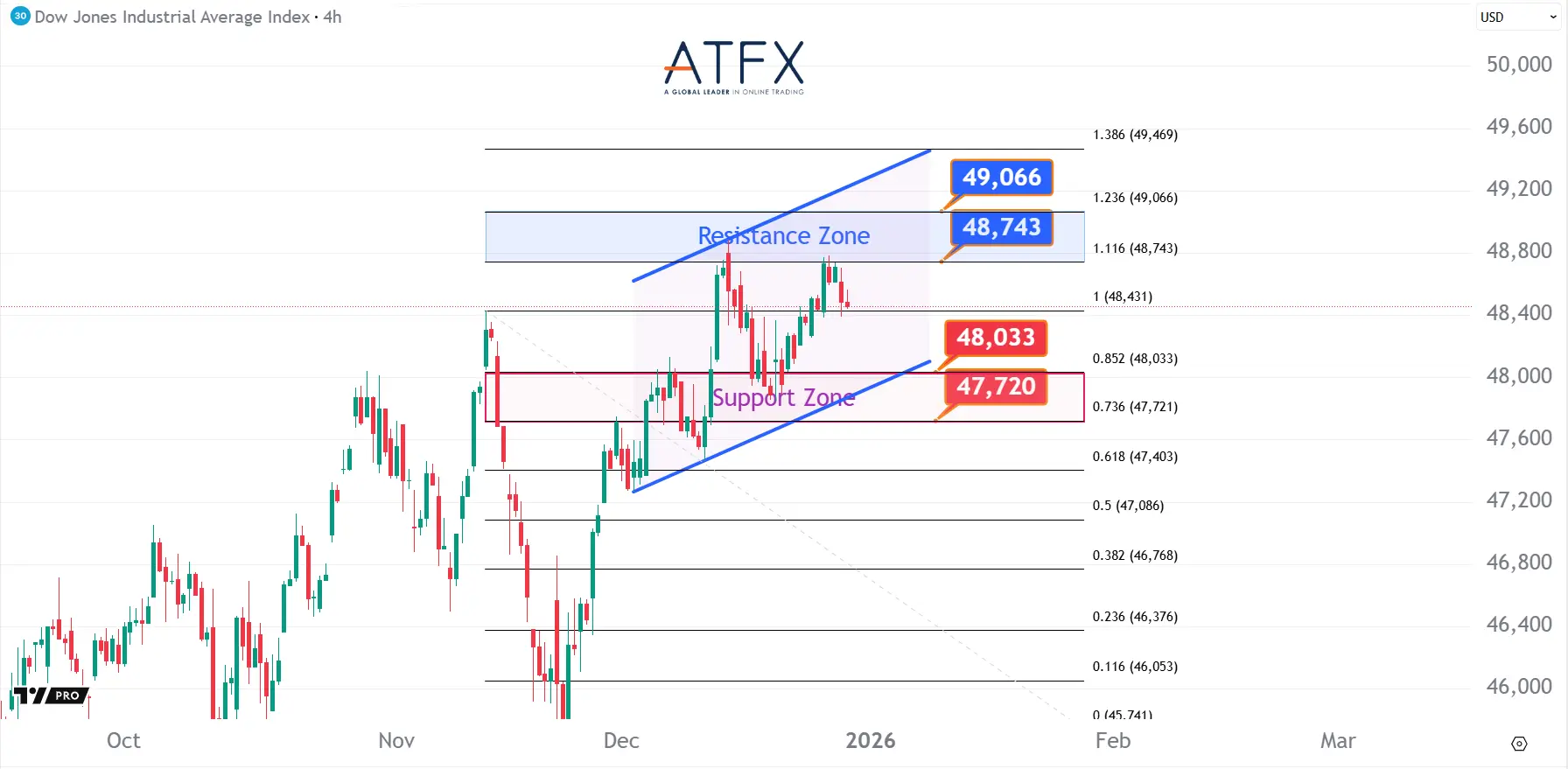

Dow Futures

- Resistance: 48,743 / 49,066

- Support: 48,033 / 47,720

The Dow Futures pulled back on year-end profit-taking amid thin liquidity. Technically, prices are struggling near the 48,700–49,000 resistance zone, while 47,720 acts as key channel support; as long as this level holds, the move looks like consolidation rather than a bearish reversal.

NAS100

- Resistance: 25,658 / 25,835

- Support: 25,237 / 25,095

Year-end profit-taking cooled mega-cap tech, though AI optimism and easing expectations still underpin sentiment. Price hesitated near 25,800, slipping into consolidation; as long as 25,095–25,237 holds, the move looks like digestion rather than a bearish shift.

BTC

- Resistance: 88,058/88,913

- Support: 85,306/84,440

Bitcoin trades in a $87,000–$90,000 range as year-end profit-taking and weaker risk sentiment cap upside, with bulls failing to hold above $90,000. Fed rate-cut expectations remain a medium-term support, but short-term momentum is pressured by equity volatility and thinner liquidity. Technically, watch $88,058 resistance and $85,306 support, suggesting continued consolidation.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.