The EURNZD pair has been pressing higher in recent sessions and has economic data this week.

Monday brings New Zealand inflation numbers; Wednesday will have the exact data for the Eurozone.

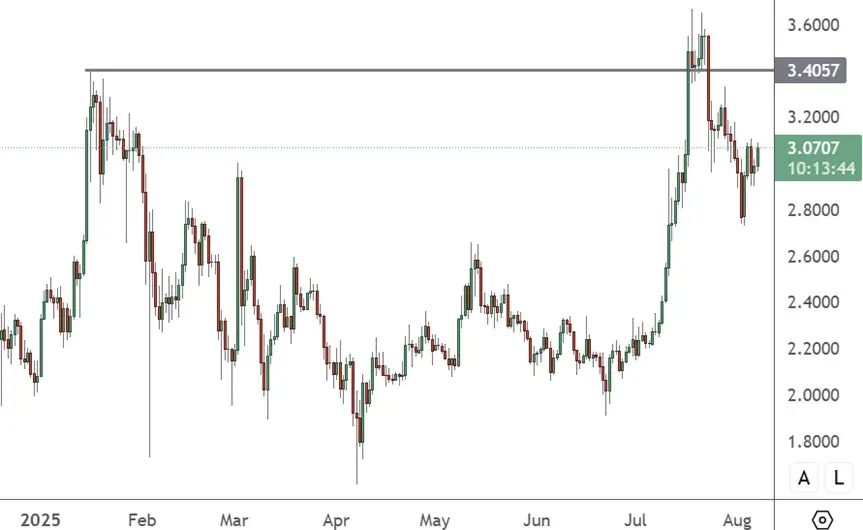

EURNZD – Weekly Chart

The euro is pushing the recent highs at 1.7477 and could move to target 1.8000 this week.

New Zealand inflation has steadily risen to 7.3%, but this month’s number is expected to be 6.6%. If the number drops, it could confirm a peak in Kiwi interest rates. The New Zealand central bank hiked rates aggressively from 0.5% in October to the current rate of 3.5%.

With inflation rising in the European Union, traders are betting that European interest rates will have to catch up to the New Zealand rate.

Before the European inflation number, we will have ZEW economic sentiment for the Eurozone and Germany. Traders often watch this to get an outlook from economists on the economy’s future path. The core inflation rate in Europe is expected to rise again from 6.3% to 6.8%. If these trends are confirmed, the Kiwi dollar can lose further ground to the euro.

The European Central Bank’s consumer expectations survey, a monthly survey of 14,000 adults from six-euro countries, forecast inflation the next 12 months and three years ahead at 5% and 3%, respectively. The central bank’s goal is to get inflation back to 2%.

“Economic growth expectations for the next 12 months increased slightly from -1.9% to -1.7%”, said the ECB.

Capital Economics has forecast further losses for the Australian and New Zealand dollar.

“Though these currencies have fallen past our once-downbeat end-2022 forecasts, we now expect both to fall further as two key headwinds persist into 2023,” said James Reilly, Economist at the group.

“We don’t think commodity prices will support these currencies, unlike earlier this year,” added Reilly.

The EURNZD can push higher into the fourth quarter but may hit a peak there if European energy supplies become strained this winter. The shadow of the Ukraine war also hangs over Europe, and euro bulls need to be on guard for any tensions escalating.