Ethereum saw further selling in the last three days, with the coin down more than 3% in late trading on Thursday.

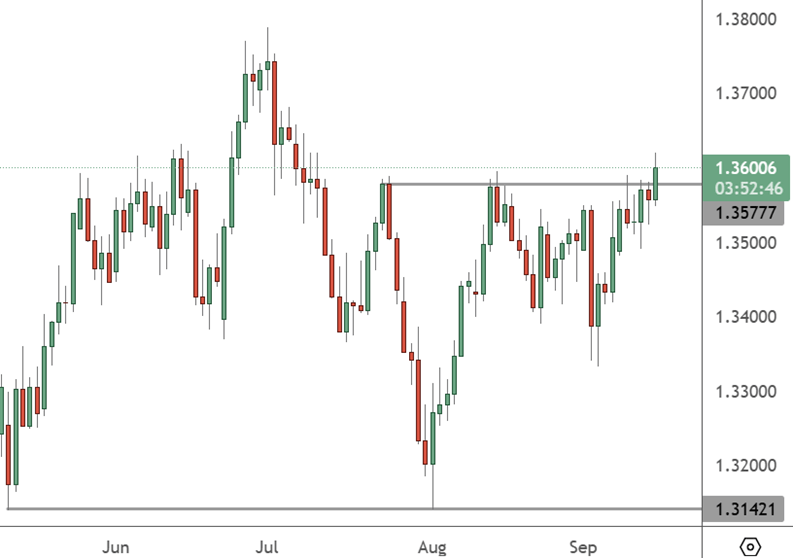

ETHUSD – Daily Chart

The price of ETH has slumped toward the support at September’s low of 3,3828. The target below would be 3,515. Another level from August is close at 3,351.

Data showed Ethereum retail traders were betting aggressively on further upside ahead of the latest selling. Hyblock Capital said Ether’s True Retail Accounts (TRAs) long percentage has reached the 90th percentile, one of the highest levels across all crypto majors.

“True Retail Accounts Long% is getting high among quite a few coins, noting percentile readings of 94% for Bitcoin, 90% for Ether, and 86% for Solana”.

Large ETH holders were also buying into the recent dip, with BitMine Immersion Technologies, chaired by permabull Tom Lee, accumulating 104,336 ETH worth around $417 million on Thursday.

The company acquired over 202,000 ETH on Sunday, with the current market value of its reserves reaching $9.3 billion. Lee had reiterated a year-end target of $10,000 per ETH, driven by increased institutional and spot market demand.

Cointelegraph noted the Crypto Fear and Greed Index was showing a “Fear” rating of 24, the lowest in a year, down sharply from last week’s “Greed” marker of 71. The decline was similar to levels seen in April, when Bitcoin dipped below $74,000.

Friday’s sharp selling and blowout of leveraged positions have weakened the market sentiment for crypto after a period of stability. Profit taking may be a theme at the moment, and some are stepping out of the market to watch for further headlines.

Further selling emerged on Thursday, driven by an earnings call from Jamie Dimon, CEO of JPMorgan, who warned of emerging credit issues. That followed the bankruptcy of an American firm last week, which rattled private credit markets and led to selling in regional banks under heavy pressure during the collapse of the defunct Silicon Valley Bank.

The crypto market also saw another embarrassing moment this week when Paxos, which manages a stablecoin for PayPal, accidentally mined $300 trillion worth of the digital asset on Wednesday. The move had a limited effect on the crypto market, but it had analysts questioning how such a large mistake could have been made.