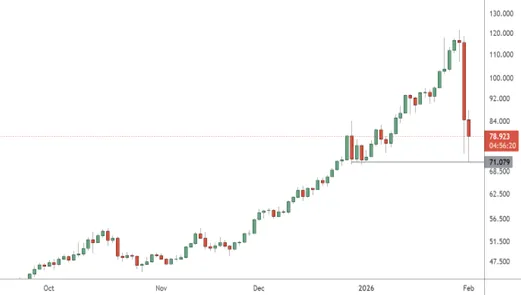

Silver prices ended a strong rally in recent weeks with a sharp drop of 26% on Friday and a loss of more than 6% on Monday.

XAGUSD – Daily Chart

The price of XAGUSD crashed to the previous resistance level at $85.00. The market then moved lower to test the previous support at $70.00 on Monday.

Donald Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair has turned the country’s interest rate outlook on its head.

Commodity strategists at Bank of America had noted recently that silver’s market is relatively small, so speculative inflows can quickly detach prices from industrial demand. The bank said that $60 per ounce was more “fundamentally justified” and warned of volatility. BNP Paribas strategist David Wilson added argued that the rally was driven by investor positioning, rather than supply issues and said profit‑taking would soon cool the market. However, Citigroup, which calls silver “gold on steroids”, had raised its three‑month price target to $150/oz.

ETFs holding silver saw record one-day losses as selling intensified late on Friday. Silver also experienced a systemic, algorithm-driven liquidation, with the 2X leveraged AGQ ETF plunging 65% in a single session.

Trump formally nominated Kevin Warsh to central banking position on Friday, starting the confirmation process and immediately sparked questions about whether Warsh will maintain the Fed’s independence or align its operations with the president’s goals.

Trump’s decision rattled markets after months of criticism aimed at the current Chair, Jerome Powell, over his failure to slash interest rates. Warsh is seen as a hawkish policymaker and the decision was very surprising to many.

Gold and silver had been leaning on sharp rate cut expectations as one of the key pillars of the recent rally. Warsh will not be in his new role until May but it does put pressure on markets this week after months of rate cut talk.